What is it?

The Doji candlestick is recognized by the candle’s open and close prices, which are usually the same. This produces an easy to identify small to nonexistence candlestick body that resembles a cross or plus sign and can be either black (red) or white (green) in color. The absence of a candlestick body signifies a price struggle among buyers and sellers, which failed to produce a clear winner.

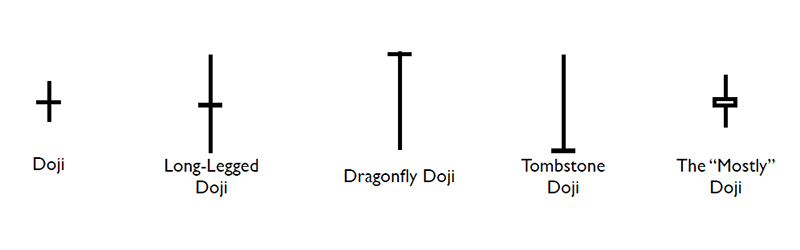

Usually, a doji will have a long upper and long lower wick, which shows a price movement during the period. However, both the buyers and the sellers failed to move the market in either direction, and the result is typically a continuation pattern. Below are a few examples of the various types of doji candlesticks.

What should I do when I see this pattern?

A doji is typically a continuation pattern unless found at the top or bottom of price trends. Then it can be the harbinger of an impending price reversal. If you find a doji at the end of a downward trend which is a known line of support, it could be a bullish reversal signal. The opposite is true as well; if you find a doji at the top of an upward trend that lands on a known line of resistance, a bearish reversal could be next. As always, you should confirm the price action of the next candle breaks above or below the doji before entering a reversal trade.