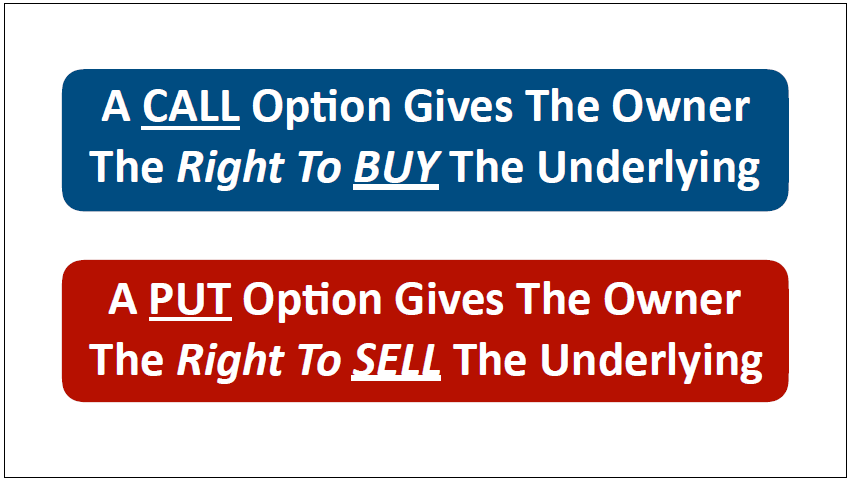

In today’s blog, we are taking the next step in our journey of understanding options. Now, the starting point of any journey is knowing where you are and where you are going. When it comes to options, you should understand the basics; that an option gives you, the buyer, the right but not the obligation to buy or sell an original asset for an agreed-upon price at a later date. Now, there are two main types of options you can trade: a call option and a put option.

A call option gives you the right to buy a stock at a specific price. The monetary value of a call option increases as the value of the underlying stock increases, which means call options are bullish in nature. These options are valuable to short-sellers as they function as a type of price insurance. For example, if the price of a stock goes up on a short trade and you have a call option in place, you can exercise that option to purchase the stock in question for a previous price point, which is lower and cover your short sale. The benefit of trading call options is the lower cost of entry, the ability to leverage more shares, and the limited risk.

On the flip side, a put option gives you the right to sell a stock at a specific price. The monetary value of a put option increases as the value of the stock decreases, which means put options are bearish in nature. These options are valuable to long buyers as they function as a type of price insurance. For example, if the price of a stock goes down on a long trade, and you have a put option in place, you can exercise that option to sell the stock in question for a higher previous price point. The benefit of trading put options is the lower cost of entry; they do not have any margin requirements, the ability to leverage more shares, and limited risk.

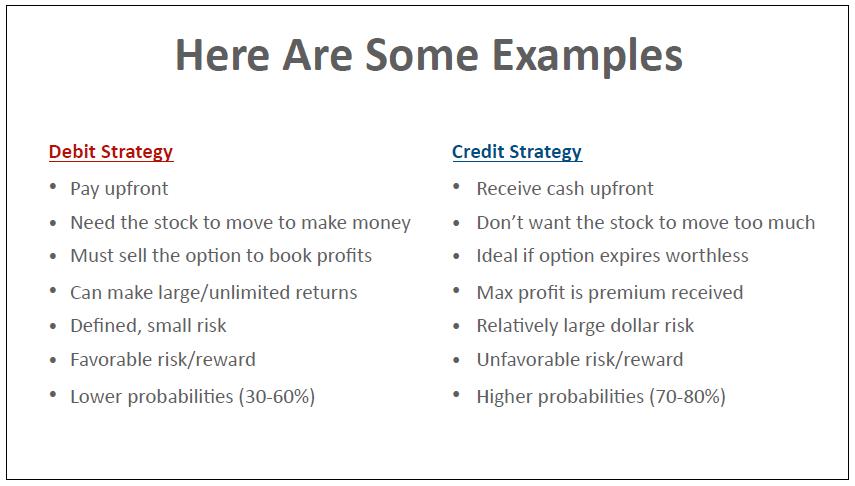

What I find intriguing about working with options is that we do not have to trade or own the underlying stock to make money with them. After all, options are tradeable, just like stocks, so we can make money with option contracts the same way we make money with stocks, such as buying low and selling high. However, we can unlock greater flexibility with our trades, more profits, and when done correctly, reduce our risk by combining multiple options. Combining options in one way might create a debit strategy while combing the same option differently might create a credit strategy.

A debit strategy requires you to pay upfront to initiate the trade in question. While a credit strategy will pay you money when you initiate or trigger the trade. These two types of trades are neither right nor wrong, and neither one is better than the other as they both have advantages to exploit and disadvantages to take into account. Below is a list of examples that are attributed to each strategy.

In Closing

Now that we have laid the foundation to what debit and credit option strategies are, join us next time as we present actionable options trading strategies which you can employ to make money and mitigate risk at the same time. Thank you for reading, and we look forward to seeing you in our next options blog!