In last week's blog, which you can read here if you like, we took an in-depth look at step 1 of the ultimate dividend, which covered finding a dividend-paying stock that you want to own. Today we will be reviewing step 2 which covers owning a dividend-paying stock and using it to your advantage.

Step #2: Sell Cash-Secured Put Options on the Stock

Once you know what stock you want to buy, do not just go into the market and buy it right away. As a savvy trader or investor, you can get a better price by using the options market. Options are contracts that expire at a specific time. When you sell a put option, you give someone else the right to sell you the stock at a certain price before the contract expires. When you look at the options chain for the stock you want to buy; you will see that you have many choices and what's another word for choices? Options! But which put option should you sell?

Picking the Best Put Option

Firstly, you should sell the put option with the nearest monthly expiration date. All optionable stocks have options that expire on the third Friday of each month. Many stocks even have options that expire every week. A week is a little too short for our purposes here to sell the monthly options.

Let us use a real example to illustrate how to find a suitable option contract. It's important to note here that I'm going to be giving you guidelines to follow when finding which options to trade.

If you are brand new to options trading, please follow these guidelines. More experienced options traders may want to tweak these parameters to fit their risk tolerance and portfolio goals. For example, experienced options traders with a higher risk tolerance may prefer to trade options that expire sooner or have strike prices closer to the spot price.

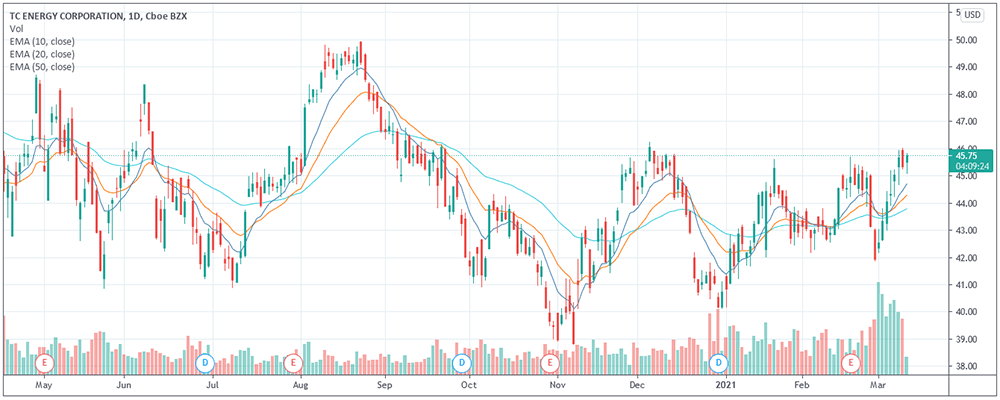

In this example, we will be looking to buy TRP shares, a $40 billion market cap Canadian energy company that pays a 6% dividend yield with a 76% payout ratio. Their dividend has increased more than 23% over the last three years, and the stock is currently trading around $43 per share.

Picking the Strike Price

The stock has been trading between $41 - $50 per share for the past ten months, only dropping below $40 twice briefly. Therefore, $40 looks like a fair share price to buy this stock.

Because $40 looks like an attractive price to buy the stock, we want to sell a put option on TRP with a strike price of $40. The strike price is the price at which the buyer of the contract can sell the stock. This means we have to be able and willing to buy 100 shares of TRP at $40 per share. With $4,000 set aside in our account, we are ready to buy the shares.

Looking at the options chain, we can see that the next monthly options expire on February 19. Point of reference, today is February 1, as I write this. The 40-strike puts are currently trading between $0.30 and $0.40 per contract. We can probably sell a 40-strike put for the mid-price of $0.35.

Remember that each options contract represents 100 shares of stock, so we have to multiply that $0.35 by 100 to reach the actual amount of $35. Because we are selling the contract, we immediately receive $35 into our account. Now, we have received cash in exchange for a promise to buy the stock at $40/share.

What Happens on Expiration Day?

If the stock drops below $40 by February 19, we may have to buy 100 shares of the stock for $40 each. If the stock is below $40 when the contract expires, we will pay $4,000 for 100 shares of TRP. The $35 we brought in for selling the put option helps offset this cost, bringing our total cost down to $3,965. Not a massive discount in this case, but every little bit helps!

By selling a put option at the price we wanted to buy the stock, we could purchase a $43 stock for $39.65 per share. If the stock never drops below $40 before February 19, then the options contract that we sold will expire worthless. When that happens, we can simply sell another option for the next month.

We could sell the 40-strike contract again, or we could adjust the price we want to buy the stock at based on how the stock has moved. For example, if the stock has shot up to $60/share by then, perhaps $40 isn't a reasonable price anymore. Maybe we would want to buy the stock for $50 in that scenario, taking advantage of a pullback.

Maximizing Premium

Some months, you will be able to receive more than $35 for selling the put options. Some months you may receive less. This depends on several factors.

Some months, you will be able to receive more than $35 for selling the put options. Some months you may receive less. This depends on several factors.

First, if implied volatility is high, options will be priced higher, which will increase the money you receive for selling the put option, called the "premium". If the stock is closer to the price you want to buy the stock at, called the "strike price", you will also receive more premium for selling the option.

The other major component is time. If you sell a contract with more time to expiration, you will receive more premium because there is a greater chance that the stock will move below the strike price before the option expires.

Putting It Together

To find a good put option to sell, choose the contract that fits these criteria:

- Sell the next monthly contract that expires at least 15 days from now.

If you're new to options trading, we don't need to go into time decay mechanics right now. As a beginner, just choose the next monthly contract. The expiration date should be between 15 and 45 days away. This will give you the right balance between receiving a higher premium and still taking advantage of time decay.

- Sell the contract at a strike price you're willing to buy the stock at.

Remember, the strike price is the price at which you promise to buy the stock. So only sell the contract at a strike price you're willing to buy at.

- The strike price should ALWAYS be lower than the current stock price.

I strongly recommend AGAINST selling In The Money (ITM) options!

Buying the Stock

Remember that you are committing to buy 100 shares per contract you sell. If you want to buy 200 shares and can afford to, then sell two contracts. Want 300 shares? Sell three contracts. You get the idea.

If the stock does not drop below your strike price by the expiration date, then you just bank the premium by letting the option expire and sell another contract for next month. If you're collecting premium every month by selling contracts, it's like collecting rent for a property you don't even own yet.

Eventually, the stock will drop, and you will be put the stock. Your broker will take the cash out of your account and transfer in 100 shares of the stock. As soon as those shares land in your account, you are ready for step #3.