Alphonso Esposito is back at it again with Tradesmart, and this time, he has revamped his teachings on trading gaps with his new class, Easy Gaps. For our new students, Alphonso is a retired owner of a successful day trading room and is now a highly sought-after trading mentor. He is known for simple, time-saving strategies and has served the trading community as an instructor at Tradesmart University since 2010. He has taught Power Trader Live and Risky Business and brings his wealth of knowledge on trading gaps to his Easy Gaps class.

What is a Gap?

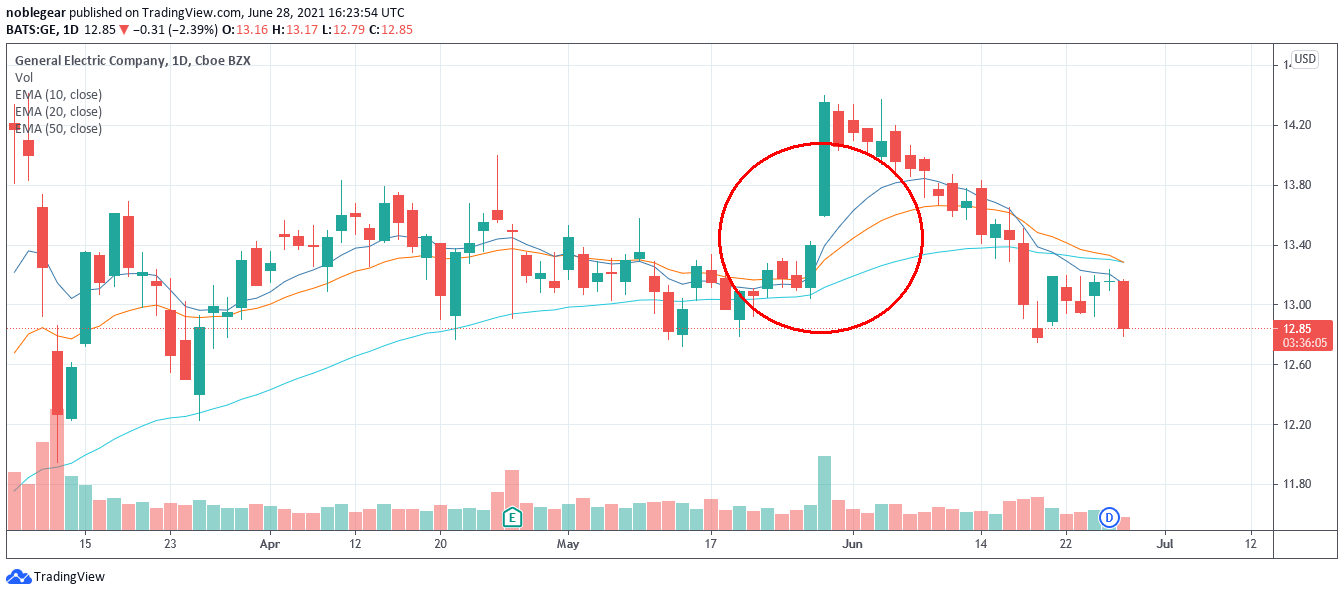

Alphonso's Easy Gaps class focuses on one strategy and one strategy only: trading gaps. A gap occurs in the stock market when there is a price break between candles of two adjacent periods on your stock chart. For example, if GE closed at $13.40 on Wednesday but opened the market at $13.60 on Thursday morning. The stock gapped up to $.20, which is reflected in the image below.

How to Find a Gap?

It would be awesome if we could place a trade to take advantage of a gap before it formed; however, that is next to impossible to do, which is why Alphonso teaches you what to do after a gap has formed. Usually, one of the best places to look for gaps to form is when company earnings are announced. If a company releases its quarterly earnings numbers and they are up from the previous quarter, the stock price will gap up during overnight trading. However, if a company releases its quarterly earning numbers and they are down, the stock price will gap down in the following period. In most cases, the news and earnings cycle drives the creation of gaps during the trading-off hours. This makes finding your trades much more manageable, as all you have to do is find the gaps after they have occurred.

How to Play a Gap?

Now that you have found a gap, it's time to figure out if it is tradeable or, as Alphonso likes, "in play." The first thing we look for is volume. If the number of active shares being traded has dramatically increased, we consider that stock to be in play and a good choice for launching a trade. Usually, when a stock gaps, the stock price moves in the same direction as the gap, and if there is a high probability of a short and intermediate move which, we can trade.

Then the following questions to ask would be where the stock is gapping from and where is the location it is gapping to. Does it run from a demand or supply zone? What does the gap candle look like? Is it a wide-range bar, a Doji "ish" candle, or a bottoming or topping tail? These questions are the best part of Alphonso's class and where his presentation shines. Simply put, Alphonso shows you how to enter and participate in gap trading by using real-world examples, and that makes this class worth every penny, as his real-world analysis is priceless.

In Closing

There is a plethora of trading wisdom out there in the world, but trading gaps is straightforward and involves less time and analysis than other strategies. This strategy needs little to no indicators and offers a high probability of short and intermediate stock moves. A stock becomes in play when there is a charted price imbalance, and we learn to take advantage of the possible trade opportunities based on market fluctuations. In short, Alphonso teaches you the keys to finding gaps and profiting from the created price imbalance. Highly recommended learning which you can purchase here.